Financial Copywriting that Generates Revenue by Captivating an Informed Investing Audience

NOTE: Although I’ve categorized examples of my financial copywriting as investment ideas, business promotions, and ad & subscription revenue generators, almost all of the examples could be used across categories.

For example, The Seeking Alpha article I’m showcasing on this page is as much a presentation of profitable investment ideas as it is a generator of ad & subscription revenue.

Likewise, the Zero Hedge article I’m showcasing on the financial copywriting to promote business page is as much an ad & subscription revenue generator as it is an effective business promotion.

Point is, my financial copywriting is versatile, like all of my copywriting.

My financial copywriting is a generator of actionable investing ideas…it generates a high R.O.I. for the readers as well as the financial sites that publish it.

Although good writing has largely gone the way of the dodo, there are still some quality financial publications out there. As I’m an advocate of good writing, I gladly subscribe to these last bastions of reverence to the written word, particularly as they’re financial publications.

Well, I was so appalled by the fluff one of those “last bastions” published today that I’ve decided to present this page as a comparison between my financial copywriting for ad & subscription revenue and the tripe one the world’s most-respected financial publications appallingly ran in the last 24 hours.

Incredibly, this Wall Street staple ran a generic, unimaginative, and uninformative X companies to watch list, with the presumed intent of generating ad & subscription revenue from it:

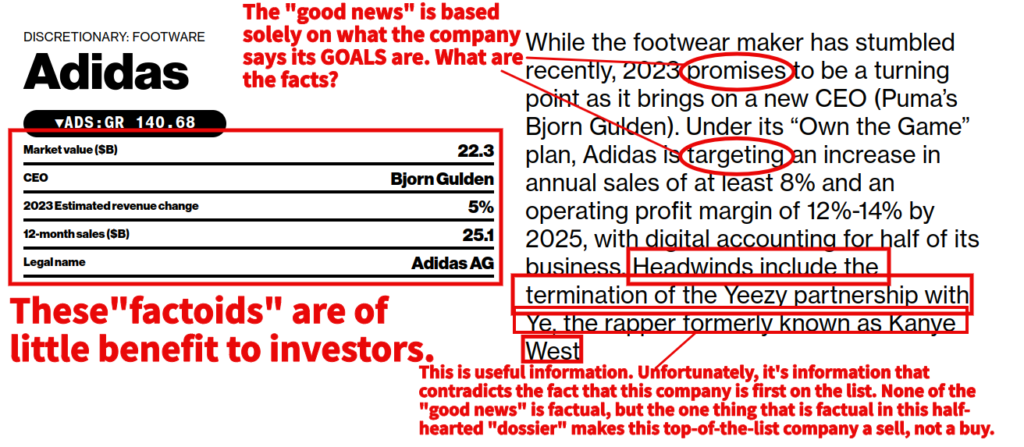

I’m a subscriber to said publication–for now–, so I got to see what was behind the paywall. It’s mind-boggling bad:

I felt robbed. Imagine if you had paid your hard-earned Super Mario coins for the above list of “50 companies to watch”, presented in alphabetical order no less. (You didn’t know that rational investors organize their investing ideas by alphabetizing them instead of prioritizing them? Neither did I.)

In a world of “free” online investing ideas (in exchange for ad placement & marketing data aggregation), the only financial news & opinion sites that can justify charging for a subscription are those that publish the highest-quality content.

Suffice to say, a bunch of fluff written by commoditized copywriters isn’t the highest-quality content.

Lest the editors of this Wall Street staple forget that–in general–regular consumers of financial news & opinion are smarter than the average meme stock trader: They’re readers.

Regular readers of financial news & opinion pay to read thought-provoking, investment-idea-generating financial copywriting.

Frequent readers of financial news & opinion won’t pay for fluff, but they will readily pay for well-researched, well-written presentations of sound investment ideas, such as my below “tech bubble bull thesis” I wrote for Seeking Alpha circa 2011. (“Now would be a good time to buy AAPL, GOOG, and the Facebook IPO.”)

NOTE: Although I’ve written for Seeking Alpha under various personas from various points of view over a span of many years, the SA articles I’ve showcased on this site best reflect my true beliefs as well as my natural writing style. (Snark levels can be adjusted according to target audience.)

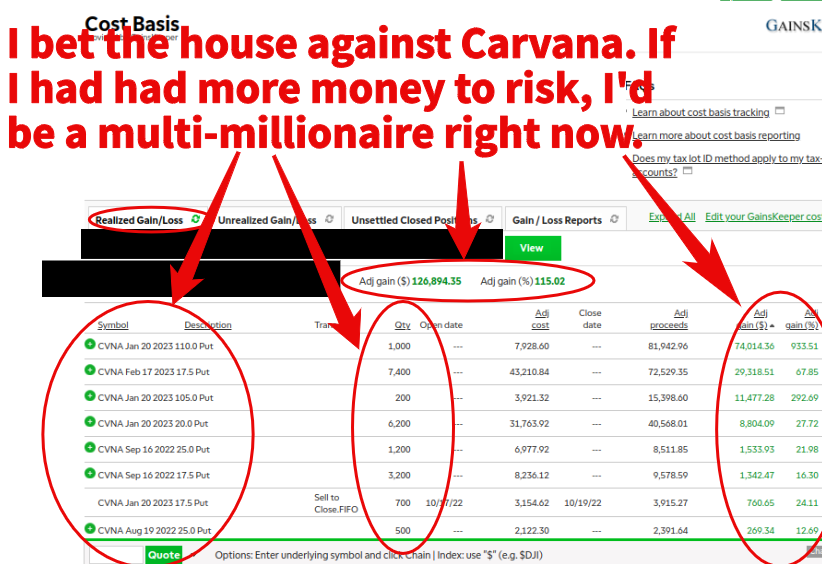

Speaking of snark, people would have paid for my 2021 bombshell about Carvana. (“I predict a Carvana bankruptcy by 2023 at the latest, and I’m betting the house against this Ugly Duckling with OTM LEAP puts.”)

Everything I said was true, the implosion happened just as I predicted, and now the world knows in 2023 what I was saying in 2021. They really missed out, and they really did their readers a disservice by missing out…don’t you miss out, too. 😁

I put my money where my financial copywriting “mouth” is.

I did in fact buy the “tech bubble 2” stocks I recommended in the above SA article, and I did in fact make well over a 100% return in the 8-9 years between when I wrote the article and the 2020 pandemic market crash. Thing is, I didn’t have much money to invest at the time, and I could only buy common stock (no options).

Common stock can be boring…the doubling of a few thousand is still a few thousand.

I did have a little money to wager on my “Big Short” against Carvana, however. (I would have bought millions in puts if I could have.)

My bear thesis was more than a bear thesis…it was the intro to the Enron 2 story. (I sincerely hope that someone will commission me to write Enron 2: The Carvana Story…it could make megabucks.)

Compare the above example of my thought-provoking, investment-idea-generating financial copywriting with the uninformative “X companies to watch” list.

Then, consider my other example of financial copywriting as investment ideas (the Carvana story) as well as my example of financial copywriting to promote businesses.

Then, ask yourself…

Am I really getting a good R.O.I. on my financial copywriting by hiring commoditized copywriters? Couldn’t I get a better return on my investment by publishing articles that my target demographic (of loyal, well-educated financial news & opinion readers) will pay to read?

The answers to those questions are as close as a tap of the button below.