Among other profitable investment recommendations, I preached about Carvana’s inevitable implosion.

I give investors and finance publications a high return on my financial copywriting by providing sound investment ideas based on exhaustive research and insightful analysis. (And, depending on the publication, a little old-fashioned Wall Street snark.)

For example, readers who followed my idea to bet big against Carvana with OTM LEAP puts in 2021 and to buy Tech Bubble 2.0 stocks while the Fed was printing like mad in 2011 made healthy returns on their investments.

Perhaps you or your financial publication could also benefit from my financial copywriting as profitable investment ideas…

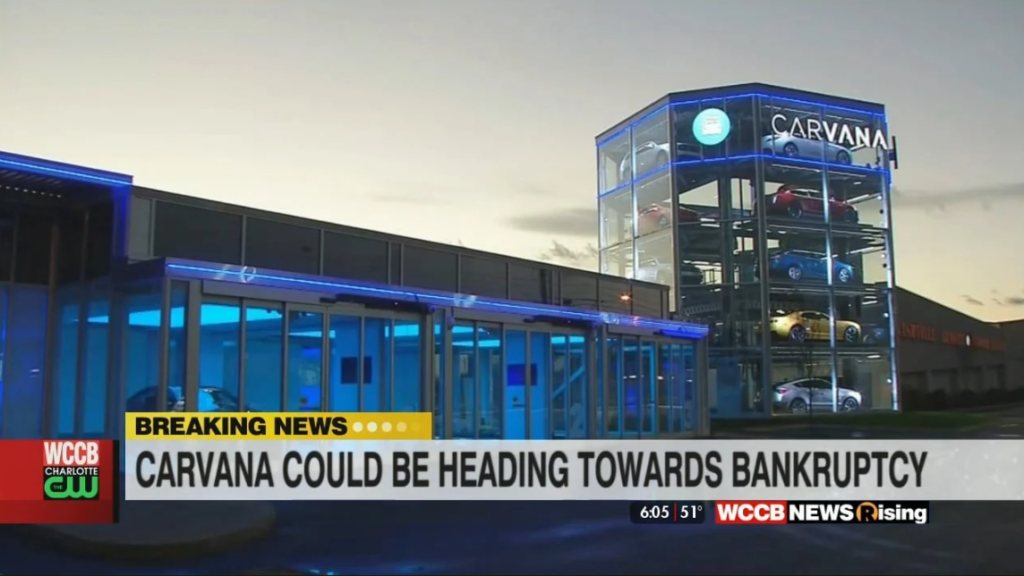

After spending quarantine going down the Carvana rabbit hole, I learned that CVNA wasn’t just the most rotten of the Fed-enabled zombie companies: It was Enron 2.

I’ve been a critic of the Federal Reserve’s exorbitant “money printing” since the the late ’90s tech bubble, and I’ve been particularly outspoken about it since 2008 Financial Crisis. In fact, I’ve been so strong in my beliefs that the modern Fed’s “ultra-easy” monetary policies have been detrimental to the economy (and to America’s middle class in particular) that I founded a nonprofit in the 2010s that aimed to educate the public about them.

Unfortunately, many of the dangers Solidus.Center tried to warn the public about have come to pass, including the proliferation of “zombie companies” that drain financial and intellectual resources from the economy at large.

At the beginning of the pandemic, I searched for the worst of these Fed-enabled “living dead” companies so I could buy cheap OTM LEAP puts against them: Jerome Powell’s Fed was printing money like Ben Bernanke’s on steroids; the torrents of money flowed right into zombie company stocks.

By dedicating quarantine to uncovering the cold, hard truths about Wall Street’s most speculative “growth” (i.e. zombie) companies, I came to the conclusion that Carvana wasn’t just the most rotten zombie on Wall Street…it was the second coming of Enron.

My research of Carvana took me down a deep, deep rabbit hole…what I found at the bottom was Enron’s playbook.

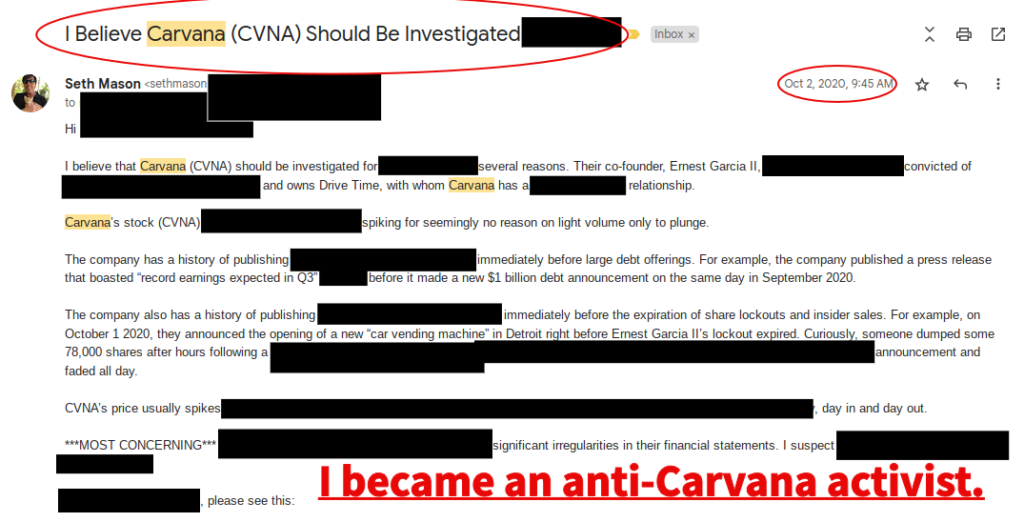

Having witnessed months of incessant pumping of CVNA in the financial media and through its “stock analyst” cheerleaders (two pages right out of the Enron playbook), I became somewhat of an anti-Carvana activist.

I “did my part” for the benefit of retail investors by publishing “tell it how it is” articles (the one I’ve showcased later on this page is the one that received the most praise), posting frequently about my findings on Stocktwits and Yahoo! Finance, and even writing the SEC, FINRA, and hedge funds & individuals that bet against scam companies (think: Michael Burry’s Scion Capital from The Big Short).

The pumping of Carvana’s stock was incessant…it was Enron all over again:

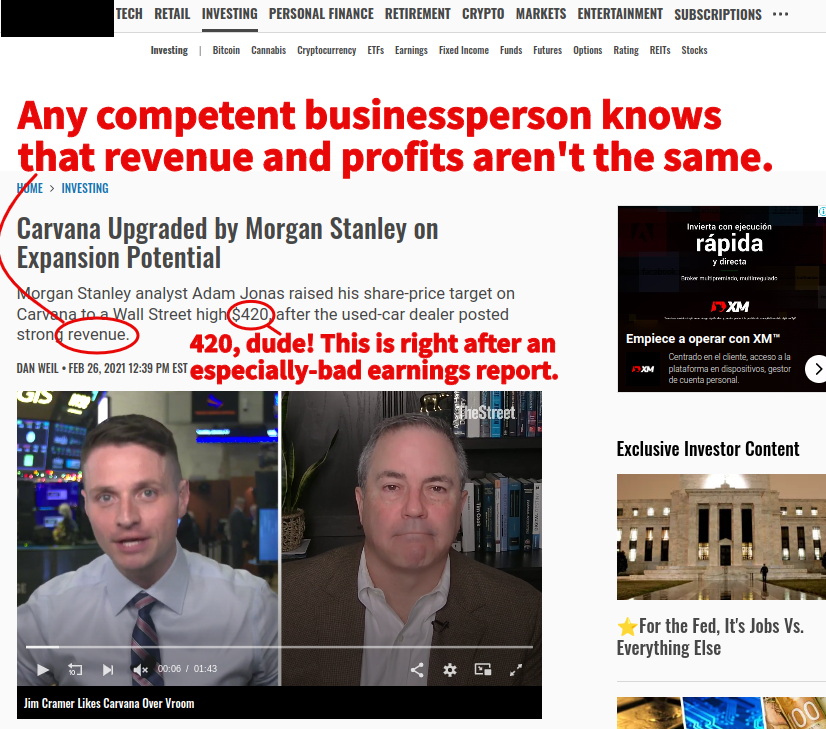

1) Analysts gushed about nonsensical metrics after terrible earnings reports and gave ridiculous price targets like $420 (dude).

2) Some financial media outlets curiously reported fluff (such as numerous “car vending machine” openings) shortly after CVNA received bad press (like losing its dealer’s license in multiple states).

3) The CEO (the co-founder’s–and former Charles Keating associate’s–son) frequently appeared on financial news shows, including one in particular that’s geared to retail investors.

It was something else…the Carvana story should be essential financial reading. I hope someone will commission me to write the whole saga. (Think: The Smartest Guys in the Room.)

For the record–at this time–I’m not claiming that Carvana paid any analyst or any financial media outlet for the publicity. I don’t write anything I can’t back up, and I don’t have proof at this time.

I think the following article is the best example of my “Carvana as Enron 2” copywriting. However, unlike my Seeking Alpha article about how to play Tech Bubble 2.0, I had to publish “Carvana (CVNA) Is Enron 2: Buy OTM LEAP Puts in 2021” as a blog post, as my (correct) ideas were seen as radically contrarian at the time.

It was their loss: It’s an exhaustively-researched and exceptionally-documented bombshell that exposed the truth about Carvana and predicted its implosion just like it happened: “Once the Fed Funds Rate passes 3%, they’ll be hard-pressed to service their massive debt.”

Think of the ad & subscription revenue a financial publication could have made if they had run it.

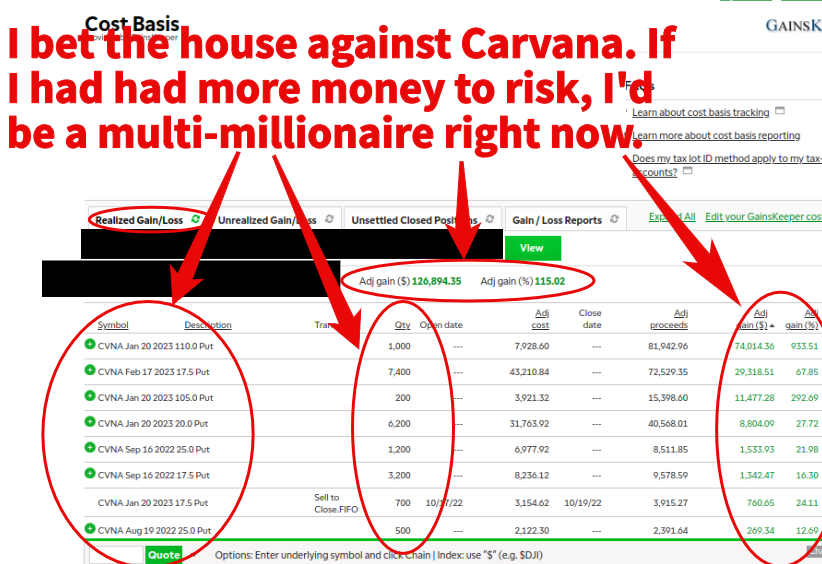

Despite publishers’ huge missed opportunity to increase its ad & subscription revenue, the people who did read my articles & posts about CVNA and followed my idea to buy OTM LEAP puts had an earnings windfall in 2022…like I did.

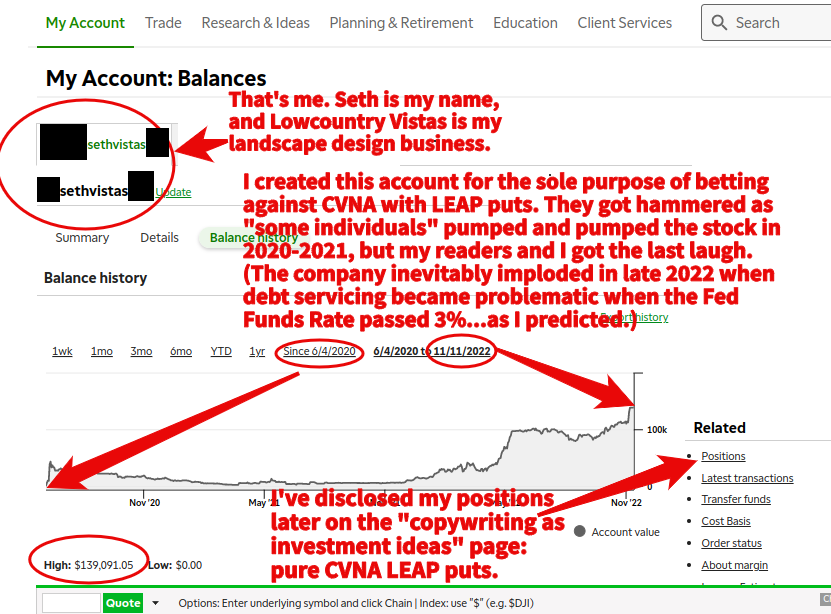

I put my money where my financial copywriting “mouth” is.

Heeding my own advice from the article, I bet everything I was willing to lose in the market on OTM CVNA LEAP puts.

After suffering losses due to the incessant pumping of Carvana’s stock in the financial media, I ended up making a very nice return when the inevitable implosion occurred.

I love to write about finance; if I had had more money to risk on those OTM LEAP puts, I’d still be a financial copywriter who brings his customers an exceptional return.…I’d just be writing from the penthouse on a much nicer computer.

Nevertheless, I did make a nice return: My research was exhaustive, my analysis was meticulous, and my conclusion that Enron 2 wouldn’t be able to hide its skeletons anymore service its debt when the Fed Funds Rate passed 3% was a slam dunk.

Readers who followed my lead made exceptional returns. You should be making exceptional returns on my financial copywriting, too.

(And I’m serious about wanting to write the Carvana story. Think: The Smartest Guys In The Room.)